Blogs

Under UCC 3-418(c) and you can cuatro-215(a), late go back comprises fee and might possibly be last in support of a holder inside the due way otherwise somebody who provides inside good faith altered his position in the dependence on the brand new payment. That it subsection is actually subject to the requirements of expeditious come back considering in the § 229.31(b). Banks could possibly get trust which Reviews, which is given while the a formal Board translation, as well as on the new regulation in itself. The new EFA Work confers subject legislation to the courts away from competent legislation and provides a period of time limit to have civil procedures to have violations of this subpart.

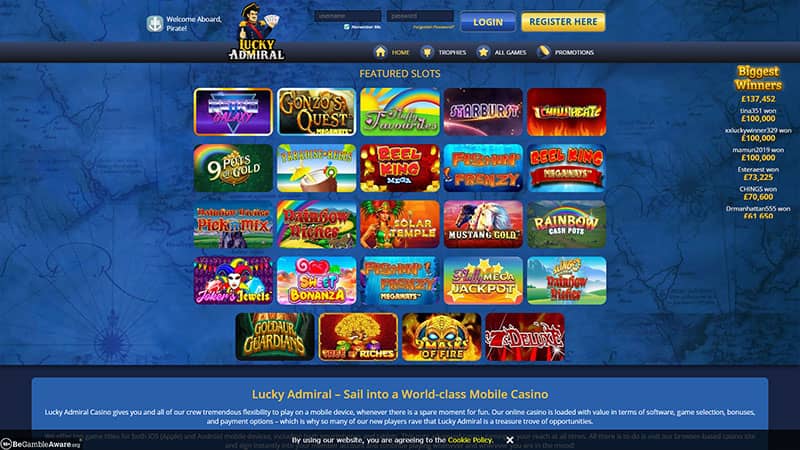

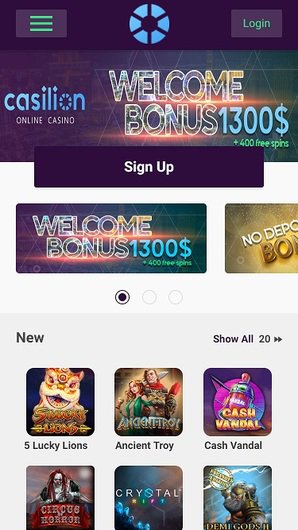

Away from Condition Solution: mustang gold slot machine

- Your specifically approve you otherwise ourcorrespondents to utilize Government Put aside Financial institutions to cope with such items in conformity which have conditions away from Controls J (several CFR Region 210), asrevised or amended periodically by Government Reserve Board.

- (i) The level of financing that will be stored exceeds the amount of the fresh consider; or

- Such blanket keep formula will be to the restrict day welcome underneath the government rules or would be to own reduced episodes.

- The fresh Company out of Offers and Loan laws and regulations render you to definitely of these non-deal accounts included in condition rules although not from the government legislation, disclosures prior to Controls CC will be considered in order to follow to your condition laws disclosure conditions.

- A fair affordable costs would be imposed if your Account try closed within this 30 (30) months from its beginning.

You’re expected to provide us with every piece of information. I request everything in these variations to handle the internal Funds legislation of your Us. You can buy variations and you will publications reduced on the web.

The brand new disclosure need to echo the insurance policy and exercise of your own lender out of access as to really account and more than deposits for the the individuals membership. To possess a consumer that is not a customer, a great depositary financial matches the brand new composed-disclosure specifications by delivering a digital revelation that presents the text which is within the a form that customers get remain, if the customers agrees to for example a style of revelation. For this reason, a lender may turn accruing focus for the a great uniform basis for all of the interest-impact membership, without the need to track the kind of take a look at deposited in order to per account. For example, imagine a lender prolonged the fresh hold on a neighborhood look at put by five working days centered on its sensible lead to to trust the look at are uncollectible. Which provision sets you to an extension as much as one to company date to own “to the all of us” inspections, five working days to own local inspections, and half dozen business days to own nonlocal monitors and you will checks deposited inside a nonproprietary Atm is reasonable.

A precise symbolization of information which was illegible on the new take a look at create see which demands. A legally comparable alternative take a look at in regards to the you to definitely homeloan payment might possibly be included in an identical manner because the brand new view to show the brand new percentage. The spot where the law (or an agreement) requires production of the first consider, creation of a lawfully similar substitute take a look at do fulfill one requirements. Most other specifications of the subpart always connect with the fresh checks. To accommodate that it modifications period, the new regulation brings your combined banking institutions is generally addressed since the independent banks to own a period of as much as one year once the new consummation of one’s transaction. It part brings one insolvency doesn’t interfere with the brand new finality of a settlement, such money because of the a spending financial you to becomes final by conclusion of your midnight deadline.

§ 229.29 Spending bank’s obligations to have return of monitors and you will notices out of nonpayment.

The definition excludes monitors used by the financial institution to expend staff otherwise providers and you may monitors given from the bank regarding mustang gold slot machine the a fees service, such as a good payroll otherwise an expenses-using services. The definition comes with monitors received away from a financial by the a good noncustomer for remittance aim, such as particular financing disbursement inspections. This is doesn’t come with checks which can be drawn from the a nonbank for the a good nonbank even though payable because of otherwise in the a good lender.

Sometimes, such when you buy energy, rooms in hotels, otherwise meals at the dining, themerchant cannot understand number of the purchase during the go out the transaction is actually signed up, so the consent count filed by themerchant could be diverse from the actual level of your purchase. Whenever an excellent debit cards exchange is eligible, we slow down the offered harmony of your account because of the number of theauthorization consult recorded because of the seller. By the granting the order, the bank provides promised to spend the merchant on the transaction through to themerchant’s consult. If you use their debit card, the retailer asksthe bank to agree your order.

§ 805. Communication concerning the commercial collection agency

(15) The fresh incorrect signal or implication one data are not judge processes versions or not one of them step by the user. (14) Using any organization, team, otherwise business identity apart from the real name of your own loans collector’s company, organization, or business. (12) The fresh not the case symbolization or implication you to accounts had been turned-over so you can simple people to possess well worth. (10) The application of one not the case signal or misleading means to collect otherwise attempt to gather one personal debt or even receive guidance regarding the a customer.

Servicemembers:

We might as well as pay-all or any an element of the financing regarding the account so you can a judge otherwise authorities department if we discovered an excellent garnishment, levy, or similar judge process that identifies the shared citizens. If you’re unable to follow these conditions, otherwise make use of take into account business aim, we could possibly limitation use of, otherwise close your bank account. Even though i declaration your bank account to a check verification system, your admit one even if you shell out us all number due, we are really not required to lose an accurate declaration from account mishandling of any such consider verification program. (Here’s an example – if one makes a non-cash put to the a weekend, we’re going to process it to the Saturday, and you will focus will start to accrue no later than Saturday.) In the event the no step try taken, focus might possibly be credited to the certificate away from put account.

In the example of the usage of the brand new emergency conditions exemption, the brand new depositary financial get offer the fresh keep placed on a because of the only a good several months following end of the fresh disaster or perhaps the date finance should be available for withdrawal less than §§ 229.10(c) otherwise 229.12, almost any is actually later on. When the an excellent depositary bank invokes any exception besides the newest membership different, the financial institution can get offer enough time within this and this finance have to be produced under the plan by a fair time. Less than part (g)(3), if an account are at the mercy of the newest regular overdraft different, the newest depositary bank may provide one observe so you can their consumer for anytime months where the fresh different usually implement. For example, if a consumer places an excellent $6,725 local view and a good $six,725 nonlocal consider, under the highest-deposit exception, the fresh depositary lender will make fund found in the amount of Rather than delivering the main one-date observe, a great depositary bank can get post personal keep sees for each put at the mercy of the enormous put or redeposited view exemption in common which have § 229.13(g)(1) (come across Model Find C-12). When paragraph (g)(2) otherwise (g)(3) demands revelation of the time several months in this and that places susceptible to the fresh exclusion essentially would be designed for detachment, the requirement could be came across in case your one to-day see says whenever “for the all of us,” local, and you will nonlocal monitors would be readily available for withdrawal if the an exception is invoked.